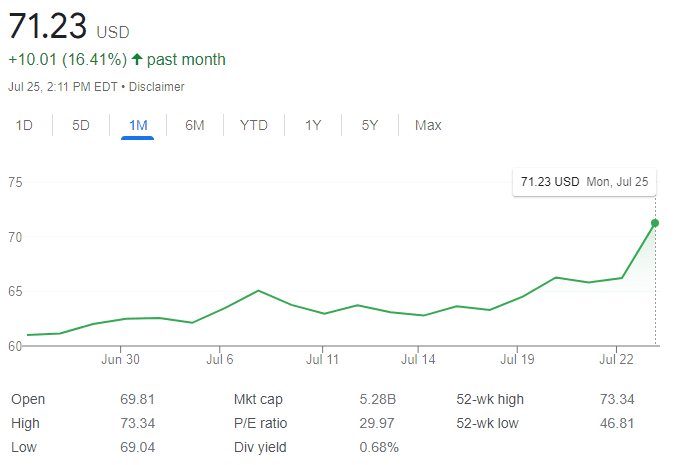

Wrestling fans have been taking note of a remarkable surge in WWE’s stock price today. The price per share is currently up around 7% from this morning’s market open. There has been a great deal of speculation about what pushed the stock so high so fast.

A common theory among fans online is that Stephanie McMahon and Triple H being named to positions of power could have something to do with it. Stock prices are typically not determined by who is booking Austin Theory’s next match, however. There are multiple reasons for the increase, and they all have everything to do with the company’s financial status and very little to do with who is writing the television shows.

In this morning’s press release announcing Stephanie McMahon and Nick Khan as co-CEOs of the company, there was a segment discussing WWE’s second quarter performance. The company is on track to nearly double its earnings guidance in the quarter that ended on June 30, 2022. That has far more to do with the increased price than the actual content of WWE programming on television.

“Our financial statements for the quarter ended June 30, 2022 are not yet complete. Accordingly, we are presenting preliminary estimates of certain financial results that we expect to report for the quarter ended June 30, 2022. The preliminary financial results are subject to revision as we prepare our financial statements and disclosures for the quarter ended June 30, 2022, and such revisions may be significant. The preliminary financial results should not be viewed as a substitute for financial statements prepared in accordance with generally accepted accounting principles (“GAAP”). Based on the foregoing, the Company expects revenue, operating income and Adjusted OIBDA to be approximately $328 million, $70 million and $92 million, respectively, for the three months ended June 30, 2022. These amounts compare to revenue, operating income and Adjusted OIBDA of $266 million, $46 million and $68 million, respectively, for the three months ended June 30, 2021. Adjusted OIBDA for the three months ended June 30, 2022 is above the high end of the Company’s guidance range of $80 – $90 million.”

In addition, some influential stock analysts have increased their target price per share for the company. That likely comes as a reaction to the financial performance of WWE. Speculation that the increase in value could lead to a sale of the company has been cited by some as another contributing factor to the increased price.

Vince McMahon’s ouster may have nothing to do with it. When Vince McMahon’s scandal initially hit the headlines on June 15, WWE’s stock closed at $67.18. The days prior, it hovered around the $64 mark per share. There was plenty of talk of class action lawsuits, as the public expected the price to fall. Surprisingly, McMahon’s exit resulted in a slight dip, but by July 7, it was back at the pre-scandal numbers again. In the long term, Vince McMahon’s hush money controversy did not hurt the stock.

WWE has been considered a strong performer on Wall Street, particularly in a slow economy. That is because Nick Khan and the company have negotiated massive television and streaming rights deals worth billions of dollars. Nobody is trading WWE based on what’s happening on television, but the money they’re making from those deals has made it attractive to investors.

Ultimately, the strong performance of WWE’s stock today stems from financial factors. Nick Khan is probably more influential over the price of the stock than Vince McMahon ever was, since he is brokering big-money, recession-proof deals. WWE dramatically outperformed earnings guidance. That, coupled with influential analysts giving investors a strong green light on the stock, is the reason for the big increase today.

What do you think of this story? Let us know in the comments!